S.B. 1767 & H.B. 1690

REP. CHRIS HURT & SEN. FRANK NICELEY

• Regulates Delta-8 & Hemp Derived THC

• Products 21 & Up

• Requires A License for Retailers and Wholesalers

•Taxes At 6.6% Like Tobacco Products

• Revenue Goes to TDA For Product Regulation & Industry Development

Hemp-derived THC (Delta-8) is FEDERALLY LEGAL

• ∆8 and all hemp derived tetrahydrocannabinols are federally legal if derived from hemp grown by licensed farmers authorized under the 2018 Farm Bill and as defined under TCA § 43-27-101.

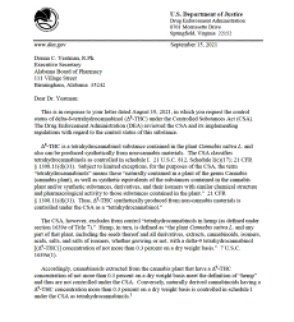

• DEA and USDA have released official statements reiterating to law enforcement that no cannabinoids derived from hemp are subject to scheduling under the Controlled Substances Act. (Letters below).

Federal legality continued…

• The DEA is only concerned with THC compliance – “hot” hemp (hemp with delta-9 THC over 0.3%) ∆8 legality comes down to how it’s produced and from where it is sourced (hemp produced under USDA approved state programs).

• If THC is produced from non-cannabis materials. It falls under the CSA consequently, Delta-8 and hemp derived THC are not under the CSA and legal federally if they are produced from CBD naturally occurring in hemp.

• Other than ∆9 THC derived from legal hemp are not included under the controlled substances act (CSA).